Key Takeaways

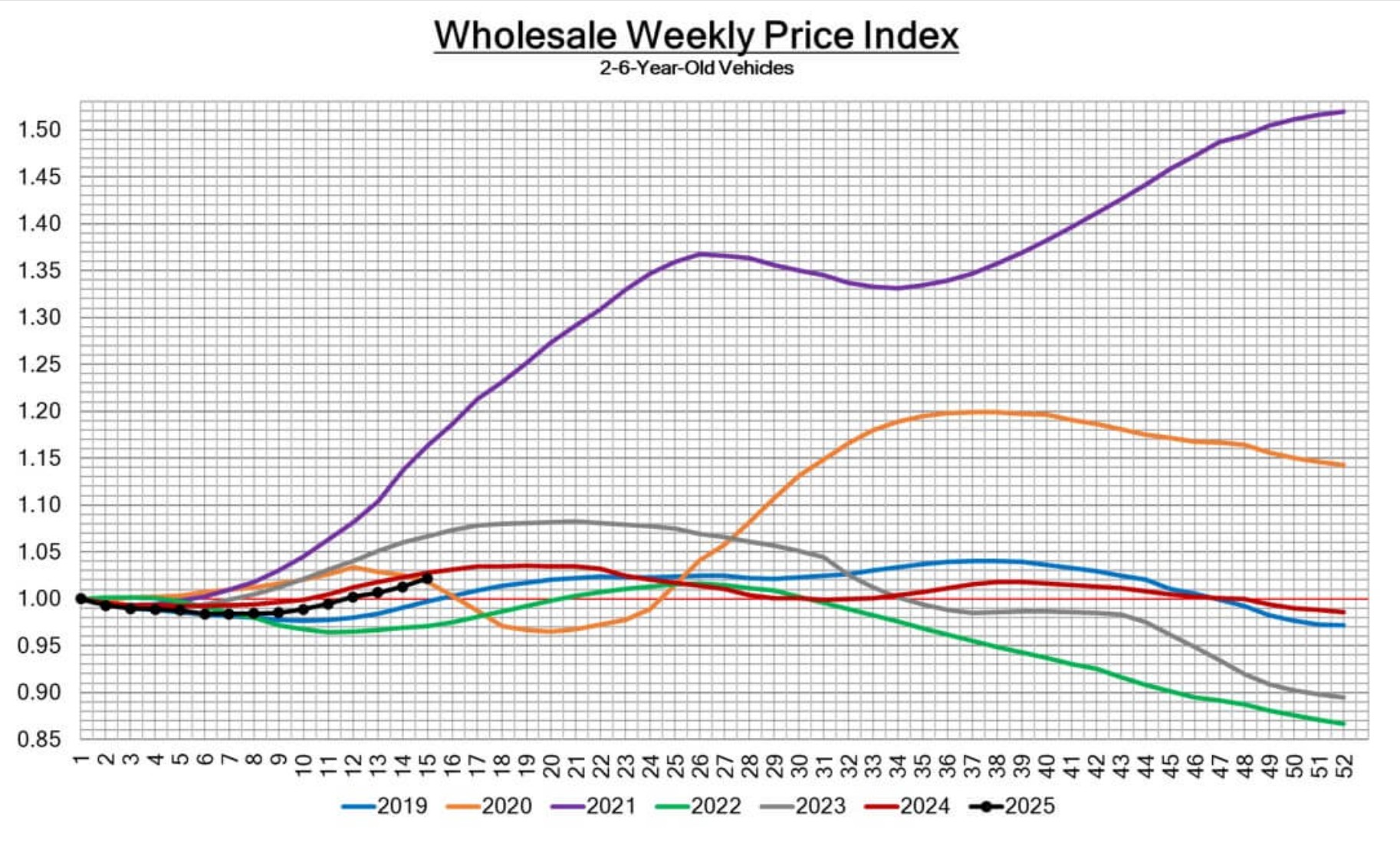

The introduction of tariffs spurred increased activity at auctions. Buyers rushed to acquire used vehicles, anticipating a decrease in new vehicle supply and a rise in used car demand.

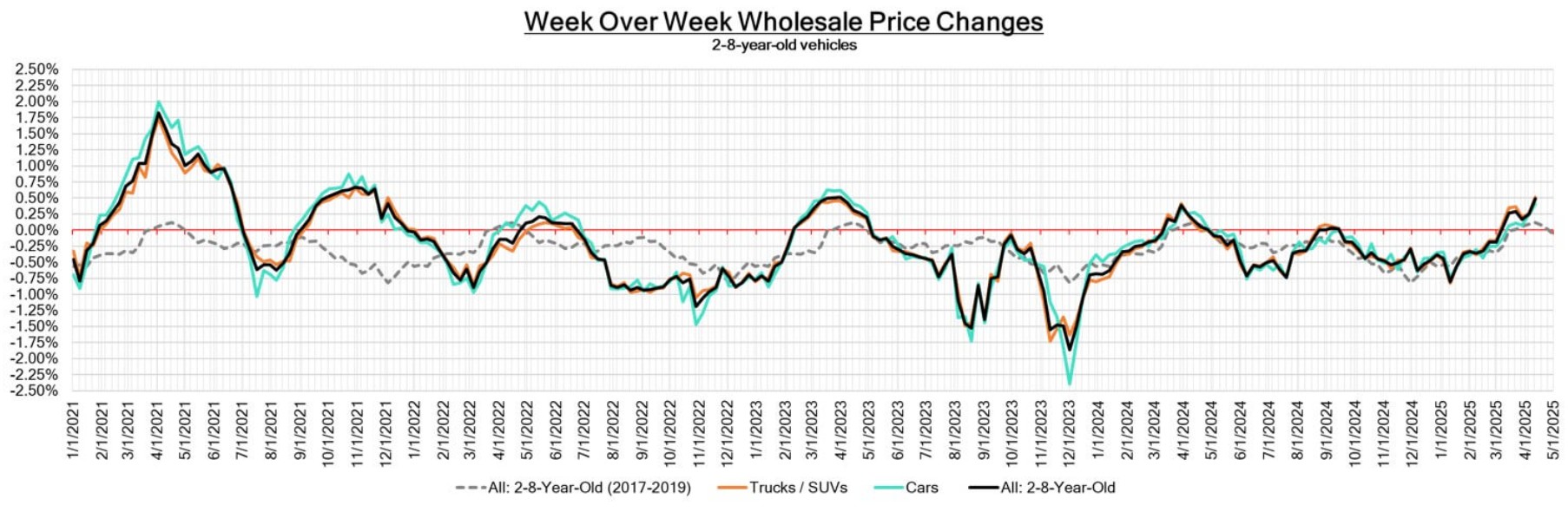

The overall used vehicle price index increased by 0.48%, more than double the average weekly growth during the same period in 2017–2019 (+0.12%).

Vehicle Segments

All nine vehicle segments experienced price increases for the third consecutive week – the first such occurrence in two years.

0–2-year-old vehicles: weekly price increase of 0.43%

8–16-year-old vehicles: weekly price increase of 0.02%

Compact cars (0–2 years): highest weekly growth since November 2021 – +1.11%

Prestige Luxury Cars (0–2 years): highest weekly growth in three years – +0.34%

Truck and SUV Segments

12 out of 13 segments experienced price increases.

0–2-year-old models: weekly price increase of 0.55%

8–16-year-old models: weekly price increase of 0.20%

Mid-Size Crossover/SUV (0–2 years): highest weekly increase since June 2021 – +0.77%

Full-Size Van (2–8 years): the only segment to see a price decrease.

Other Indicators

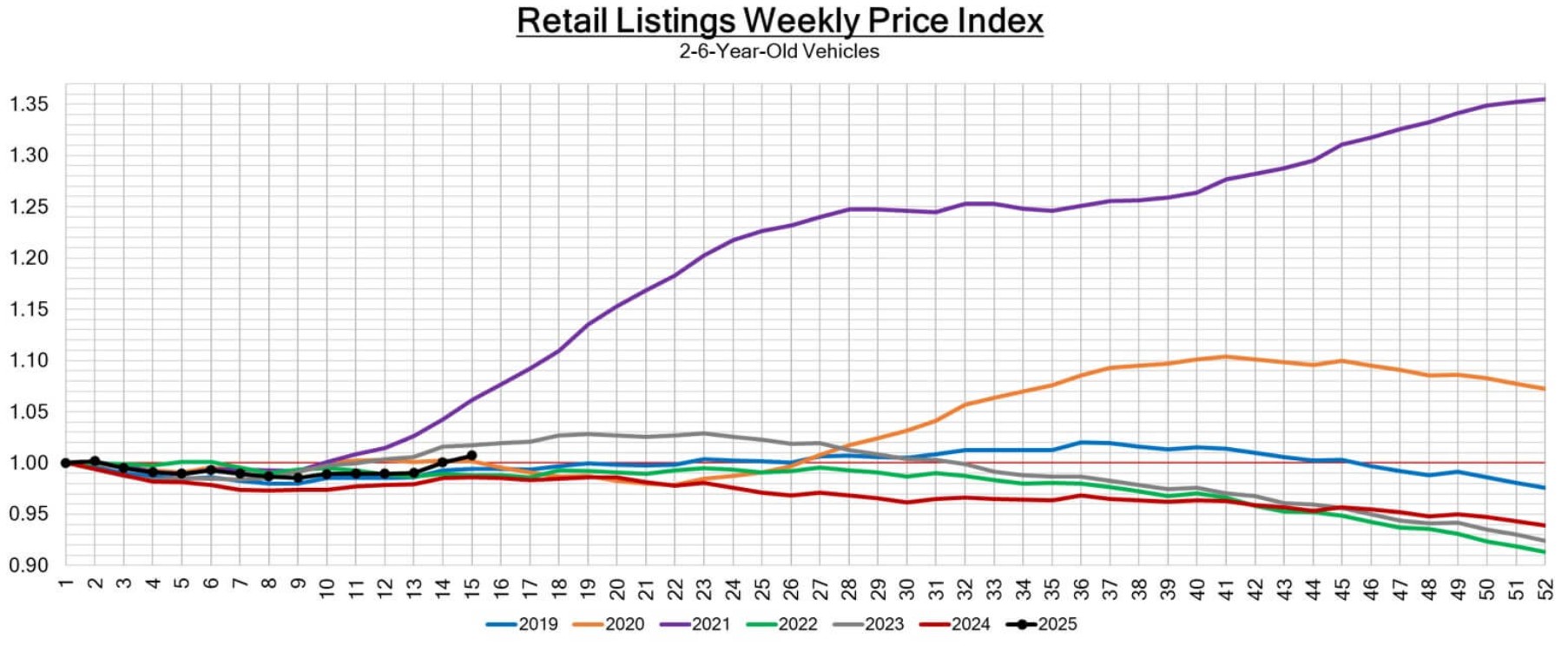

Used vehicle retail index: based on approximately two million vehicles on U.S. dealer lots, the index shows price growth.

Average selling time: the average time to sell a used vehicle dropped to about 40 days, indicating faster turnover.

Conclusions

The introduction of tariffs had a direct impact on the used vehicle market, causing price increases and more active auctions. Particularly strong growth was observed in newer model segments such as compact and luxury cars, as well as mid-size SUVs. This shows the used car market reacts quickly to policy changes and may be sensitive to further tariff or regulatory developments.

Source: BlackBook