Key Takeaways

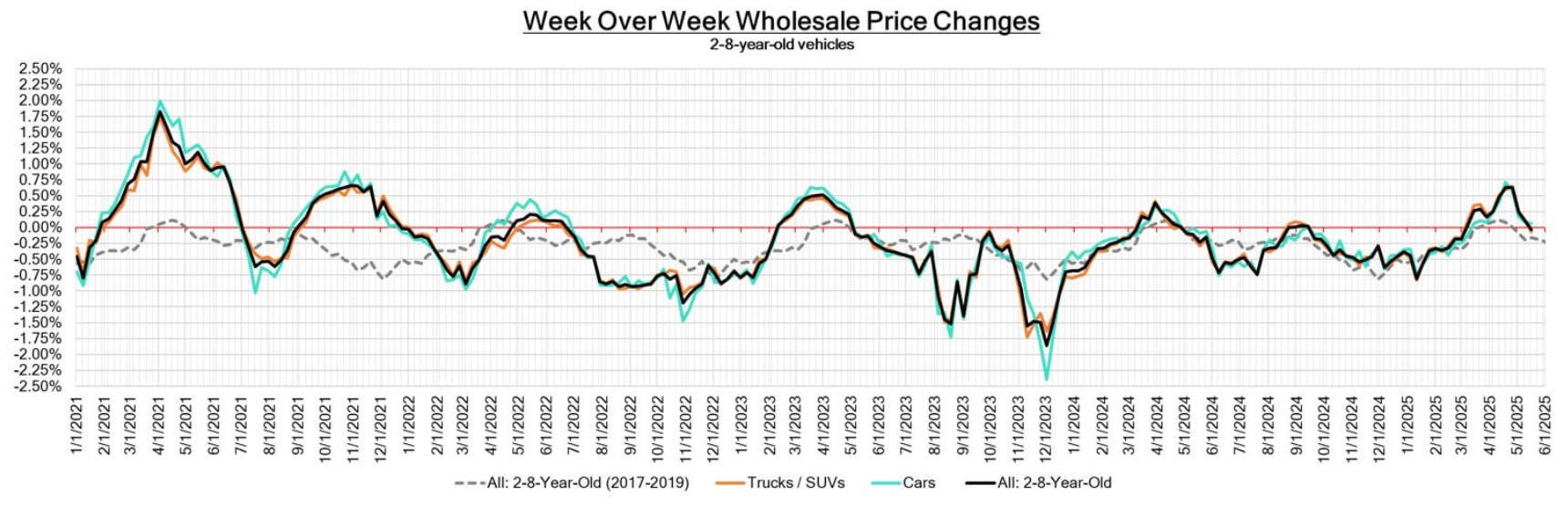

After ten consecutive weeks of wholesale price increases, last week marked a shift in trend with a slight 0.03% week-over-week decrease across the overall used car market. However, the slowdown began three weeks earlier, during the first week of May, when the U.S. delayed or suspended some tariffs, calming the market.

The wholesale market is beginning to show signs of decline. Overall, the market remains slightly positive, but certain segments have started to drop.

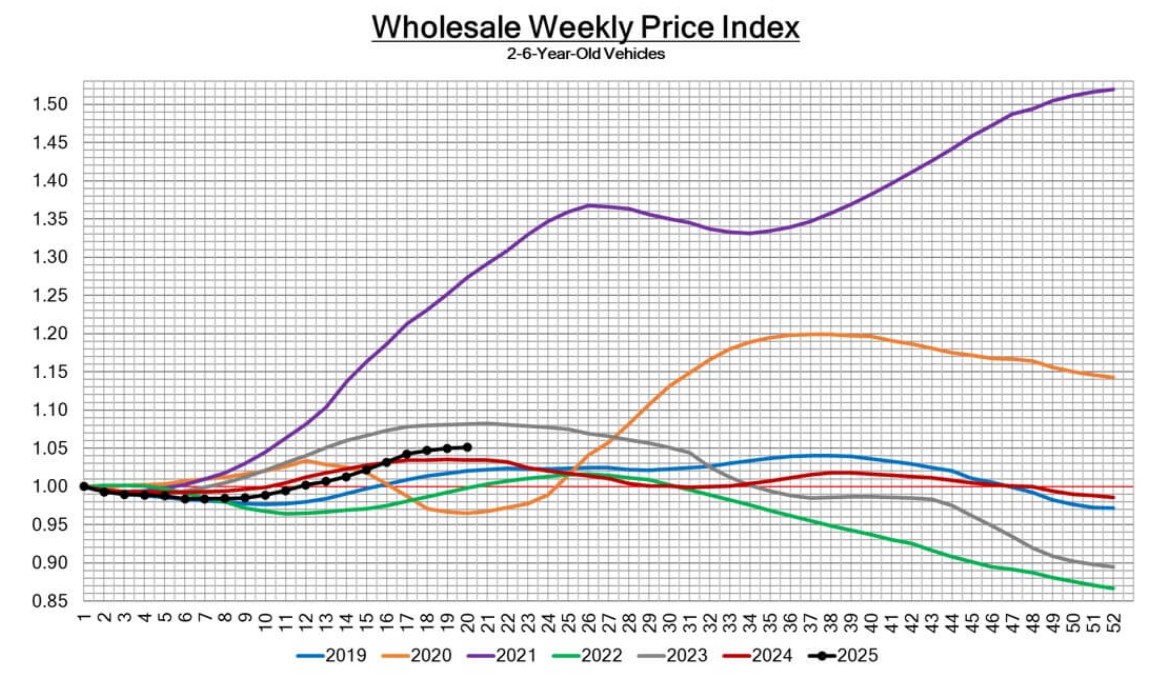

Weekly Wholesale Price Index

The chart below examines wholesale pricing trends for 2–6-year-old vehicles, indexed to the first week of the year. The index is calculated by keeping the average vehicle age constant to reflect true market changes.

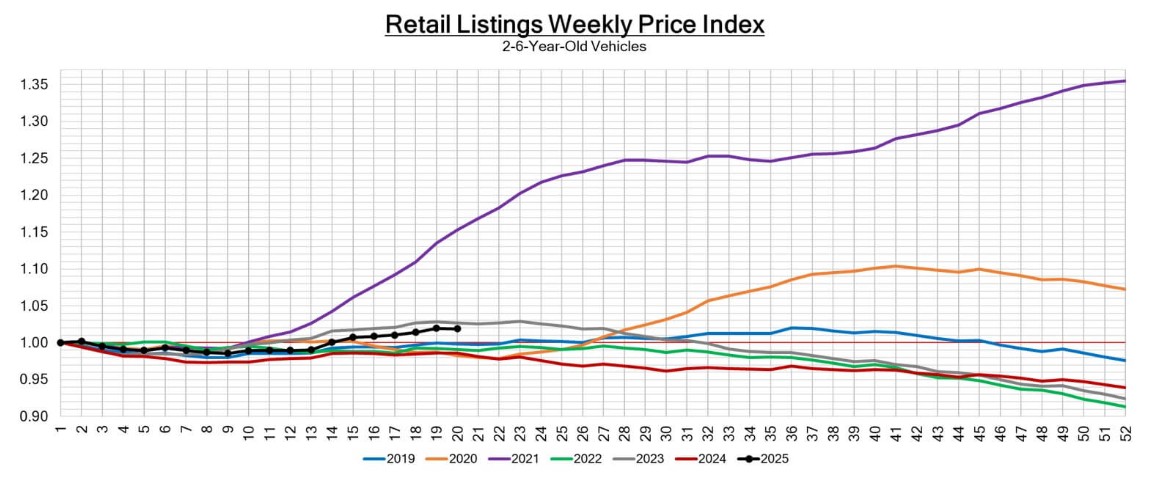

Weekly Retail Price Index

This analysis is based on approximately two million vehicles listed for sale on dealership lots across the U.S. The chart below focuses on 2–6-year-old vehicles. The index is calculated by maintaining a consistent average vehicle age to reveal real market trends.

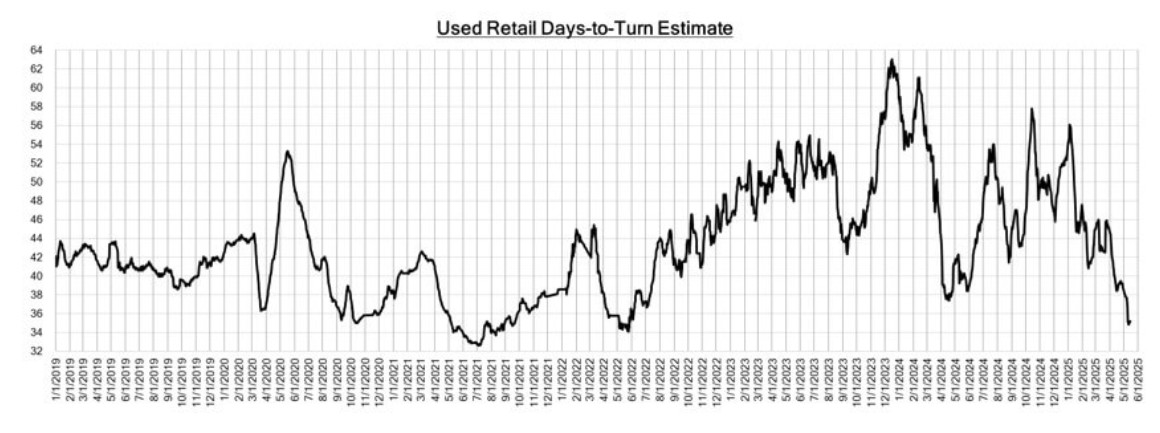

The current average time to sell a used car in the retail market is 35 days. This is the lowest figure since July 2021, during the post-pandemic recovery period, and it is likely still influenced by consumer fears of car price hikes linked to U.S. tariff policies.

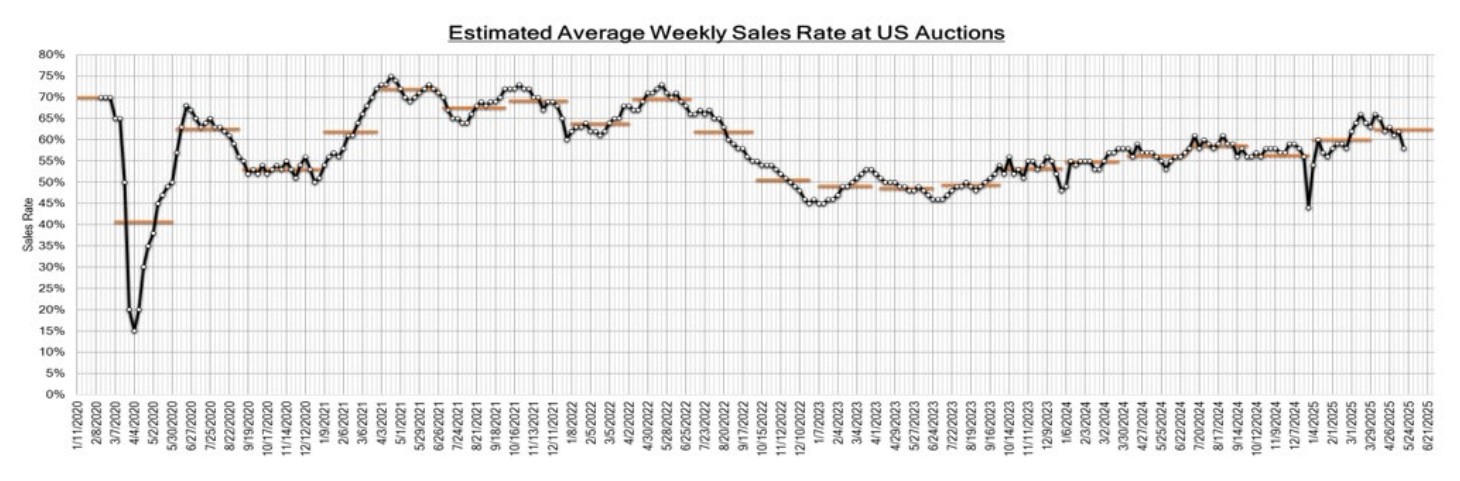

Weekly Auction Sales Rate in the U.S.

Last week’s auction conversion rate was 58%. Auction conversion rates fell to their lowest point since the end of February. However, the total volume of inventory at auctions is comparable to levels seen in January, indicating a noticeable shift in market activity and demand dynamics.

Prepared using data from BlackBook